Are you self employed in Germany? Taxes are a very elusive field. Especially for self-employed and expats in Germany, a lot of special rules apply, so that it's hard to really understand what needs to be done. For those of you just starting out, our partners at Accountable have collected 9 valuable tax tips for freelancers and self-employed in Germany that we would like to share with you.

1. Get your paperwork in order

Many entrepreneurs think first of their business when they start. The accounting comes later. If documents are collected at all, then in shoe boxes or plastic foils. Do not do that! You will lose a lot of money and time, getting your paperwork in order may be the most crucial step regarding taxes. Once you can find everything easily, taxes are actually a breeze to do.

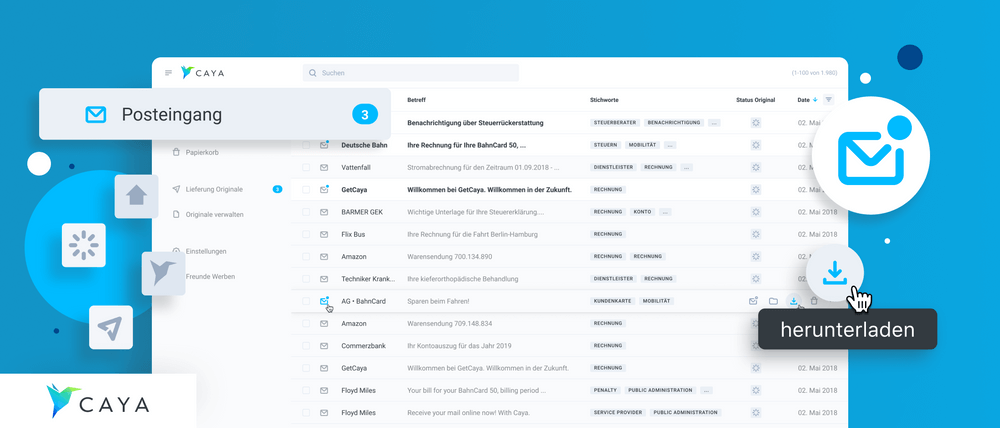

It is quick and efficient to proceed systematically and disciplined from the beginning. Paper usually leads to chaos and stress, as you cannot find important documents or spill your coffee on it. Also, it will take a lot of time and manual work to get everything in place. Instead of choosing the classic paper route, how about you receive all your important documents digitally right away? CAYA is a digital mailbox that allows you to receive and handle your important letters wherever you are and without the annoying paper that usually comes with mail. Say goodbye to not finding important invoices as all your letters will be stored on their platform and you’ll be able to find them via their search. Additionally, you can pay invoices straight from the CAYA platform, upload additional documents that you scanned manually and export your letters directly to your other tools - for example Accountable.

Getting everything right from the start is important. So having your folder structure set up is an important step to finding everything you need. Luckily, CAYA allows you to create personal folders where you can store your incoming letters and upload additional documents. We have written a more in-depth guide to a solid folder structure here (in German), but let’s take a look at the key points:

Create a folder named "Invoices & bills" or simlar with four sections:

- Unpaid bills to clients: Once you’ve sent an invoice to a client, file it here. (You can use this free invoice template to create legally correct invoices for Germany.)

- Paid invoices to customers: Once a customer has paid, put the invoice to this category. Note the payment date on the invoice.

- Receipts and incoming invoices: You must document all expenses. File these receipts here and take a look at them. Can you still read and understand the receipt in a year’s time? Is the receipt self-explanatory?

- Bank statements: You will not receive all receipts or invoices for expenses automatically. At the end of the month, check the bank statements to make sure you haven’t forgotten anything.

💡Tip from CAYA: Make it easy on yourself and always attach documents to the top of the respective category. And: don’t put it off, do it immediately.

2. Use the deductibility of business expenses

As a self-employed person you have to take care of a lot of things yourself. At the same time you have more opportunities to save taxes.

Vorsteuer: This is the VAT that you have to pay when you buy goods or services. Generally you get it back from the tax office as a normal entrepreneur. There are of course exceptions. Kleinunternehmer, for example, do not get the VAT refunded.

Income tax, Soli (Solidaritätszuschlag) & trade tax (Gewerbesteuer): These taxes depend on your profit. The higher the profit, the higher the tax rate. So the more you earn, the less you will have left in the end, at least in percentage terms. But you can lower your taxable profit with business expenses and save a lot of money.

Example:

Marie works as a designer and has a profit of 40,000 euros a year (marginal tax rate: 40%). She buys a camera for 500 Euros. This is what she will get as a tax refund:

Sales tax 80 euros + Income tax and Soli 168 Euro + Tax advantage 248 Euro

💡 Tip from Accountable: As a self-employed person there are a number of business expenses that you can (and should) claim for tax. Nobody always has all the detailed rules about taxes in their head, so all the tax rules are included in the Accountable app. This means you get the right tax tip for every expense at the right time and don’t find out about missed tax savings at the end of the year.

You can also use Accountable's “Tax Savings Search Engine” to search directly for the issues that interest you most.

3. Deduct the costs for your home office

Most people are familiar with these rules: If you work in a home office, you can deduct the costs in proportion to the total living space. But not everyone can deduct his or her work space at home for tax purposes, because the prerequisites are strict:

- It must be a lockable room. A work corner in the living room is therefore not deductible.

- The room must be used almost exclusively for business purposes. A sofa bed is already a problem.

- The study must be the centre of all professional and business activities. Otherwise the costs can only be deducted up to 1,250 euros per year – and only if no other workplace can be used for a particular activity. So as soon as you work in co-working, costs for a home office are not deductible. Are they?

And now three tips that you might like to know:

Even if you have a co-working desk, you may still be able to deduct up to 1,250 EUR for a workspace from your tax bill if you cannot do confidential work such as bookkeeping, taxes, etc.

If you rent a room as an external office from your neighbour (not in the same house), this does not fall under the strict ‘home office’ rules and the costs are generally accepted.

Are you the creative type? If you have a studio (for e.g. photo shootings) in your apartment you can deduct it. The strict rules for home offices do not apply to studios.

4. Don’t forget to deduct your work equipment

Don’t have a room for a separate home office? Your home office equipment is still deductible. Work equipment such as desk lamps, desks, shelves or office chairs that are not in a separate room can also be claimed as expenses in any case.

⚠️ Work equipment that costs a maximum of 952 euros including VAT can be fully deducted in the year of purchase. If the costs are higher, you have to spread the costs over the expected useful life (you can find the official list here).

5. Educate yourself and save taxes

Expenses for business training are deductible as long as it helps you generate income. Do you work as an expat in Germany? German lessons can be a business expense. All costs in connection with these expenses are deductible: do not forget the associated travel costs, additional per diems, etc.

6. Reduce taxes with per diems

Self-employed in germany and working more than 8h/day at a client’s office? For assignments on site at the customer’s premises that last longer than 8 hours, you can claim the per diem of 14 EUR (12 EUR until 2019).

You can of course also deduct these per diems & travel allowance if you are traveling for business. Don’t forget, that for travel outside of Germany there are per diems up to 62 EUR/day (e.g. London).

7. Save taxes when on business travel & in restaurants

Do you have a monthly ticket (Monatskarte)? A monthly public transport ticket is tax-deductible if it is cheaper than the number of single tickets you would need to make your business trips (e.g. for customer visits).

For the same reasons a Bahncard can be tax-deductible. If you have saved so much on professional rail journeys that the purchase was worthwhile, the tax office doesn’t care if you also use the card for private journeys.

For business meals in restaurants, hotels, etc., only 70 % of the reasonable and proven entertainment costs may be deducted as business expenses. The invoiced turnover tax is fully deductible as input tax. Business meals at your home are not deductible.

💡 Tip from Accountable: The tax office checks if the restaurant invitations are reasonable. This depends on the size, turnover and profit of the company. Simply put, make sure that your restaurant expenses are plausible. A salesperson in the field service certainly has higher restaurant expenses than a software developer. However, a software developer can also invite his colleagues or business partners and thereby easily acquire new projects. In the Accountable App you will be automatically informed if you exceed the appropriate amount or if you could add more restaurant expenses.

8. Pay attention to tax prepayments

Tax prepayments can become a liquidity trap and, in the worst case, lead to bankruptcy.

A short illustration:

Ben is a software developer and has been self-employed since 2018. At that time he applied for his tax number and initially stated low income. It worked so far and he had to make very little tax advance payments. However, Ben’s business has developed very well. The shock comes in autumn 2019: Ben has to pay 10,000 euros for 2018 and another 10,000 euros as a subsequent advance payment for 2019.

Self-employed people experience this or similar situations very often. If the income increases very significantly, the tax prepayments only increase after a while. This is why you have to remember to save money for taxes early on.

Therefore, regularly check how your income is developing and calculate the possible additional tax payment. January is a good time to look at the past year. If it turns out that a high additional payment is imminent, you still have enough time to save money. Because the tax return must be submitted until July 31. If you’re working with a tax consultant, the submission deadline can even be extended to the end of February of the following year (the tax return for 2020 therefore has to be submitted by February 28, 2022).

9. Prepare for the future today

Many freelancers are happy about the incoming payments and are not aware of the fact that as a self-employed person, you are also responsible for your own pension. How you plan for your future is entirely up to you. However, you should start to put something aside early on. Rürup plans, for example, are tax-privileged. But maybe you can also pay into the artists’ social security fund (Künstlersozialkasse) and save a lot of money? Find out about your pension provision at an early stage. The contributions required to get by without a job in old age are usually higher than you might think.

These 9 tax tips will make it easier for you to navigate the jungle of German tax law. CAYA and Accountable are there for you to assist you during every step of you freelance adventure.